Portfolio Management Services

RENAISSANCE OPPORTUNITIES PMS (Large Cap Portfolio)

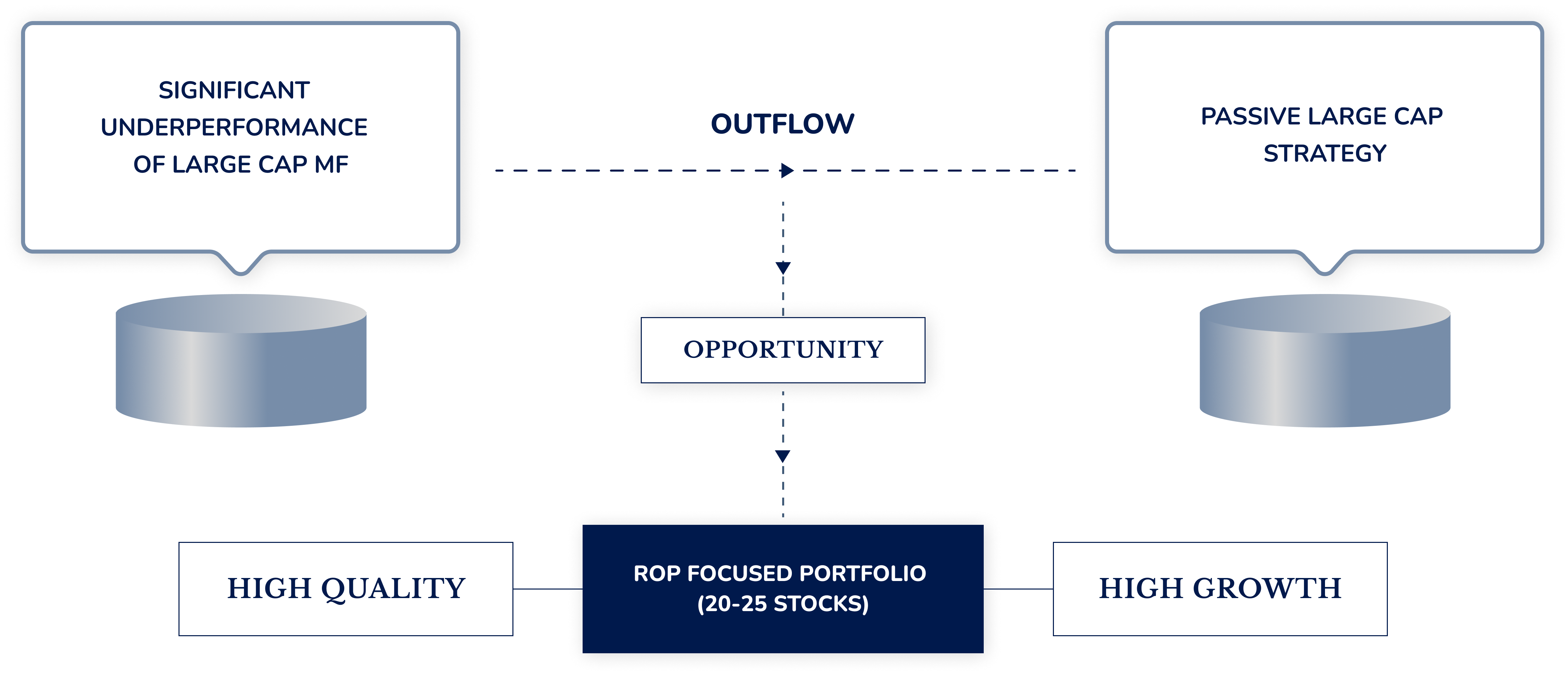

Outflow

About the fund

Renaissance Opportunities Portfolio is a Growth Oriented Large Cap Portfolio. The portfolio invests in Good Quality Large cap companies that can deliver strong growth over the medium to long term. It’s a focused portfolio of 20-25 companies that is built on a bottom-up approach on best opportunity basis. Our portfolio companies are the market leaders in their respective industry and are managed by competent management team with high standards of corporate governance.

INVESTMENT STRATEGY OF THE PORTFOLIO

High Quality Large Cap Portfolio

Portfolio build on best opportunity basis

Blend of Growth & Quality

Large cap oriented portfolio with ~70-80% weightage

Focused Large cap portfolio of 20-25 stocks

KEY THEMES

RENAISSANCE INDIA NEXT PMS (Flexi Cap Portfolio)

Renaissance India Next portfolio is Flexi Cap oriented strategy and adopts a true to label flexi cap approach by investing in companies across market capitalizations. The portfolio shall invest in high quality, high growth companies at reasonable valuations. It is a diversified portfolio with no sector bias and is constructed on bottoms up basis with best investment ideas. The Portfolio aims to deliver superior risk adjusted returns with moderate volatility. It is a High Quality Focused portfolio of 20-25 stocks.

INVESTMENT STRATEGY OF THE PORTFOLIO

A Flexi cap strategy focused to deliver Sustainable High Returns

Capitalize on the opportunities offered by mid and small cap stocks

Optimal portfolio construction which strike balance between risk and reward

Diversified Portfolio with No Sector Bias

It is a High Quality Focused portfolio of 20-25 stocks.

KEY THEMES

RENAISSANCE MIDCAP PMS (Midcap Portfolio)

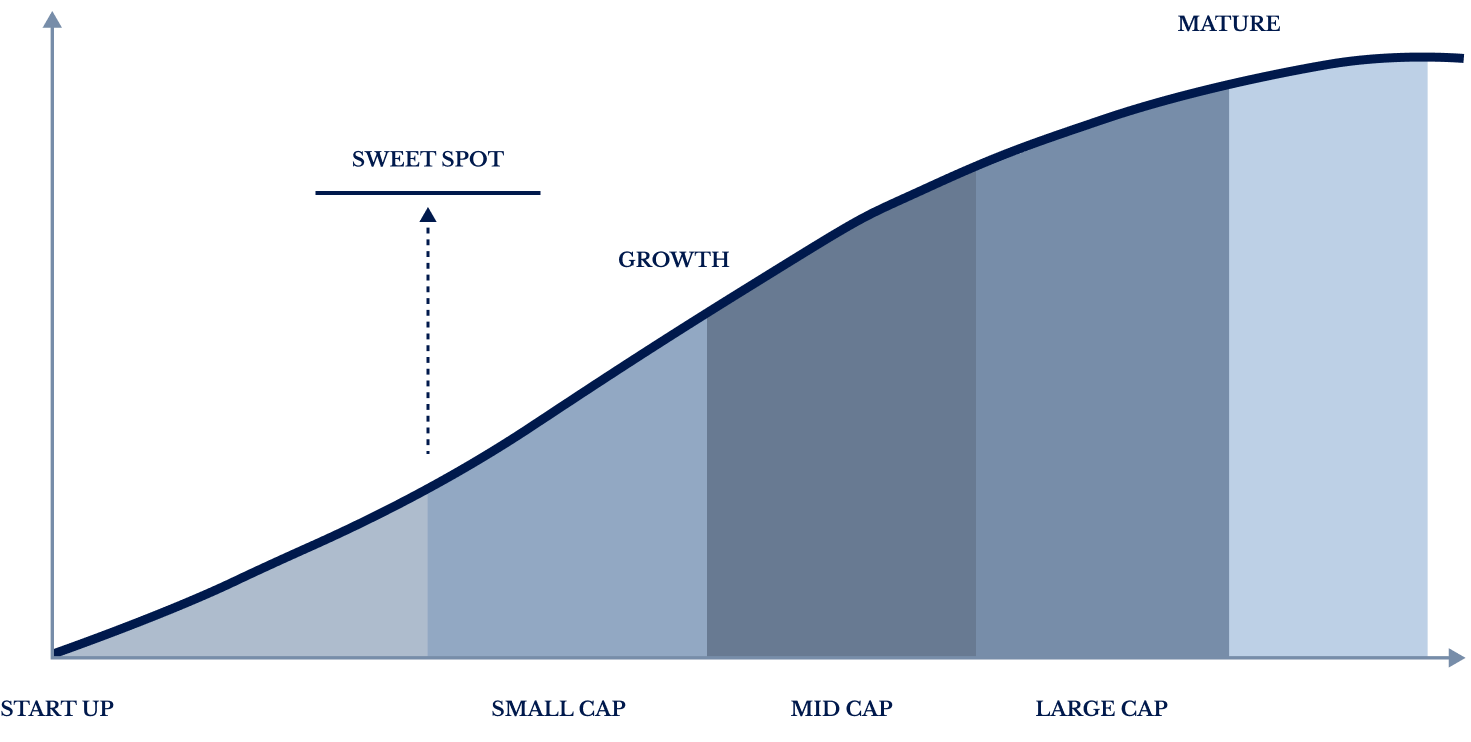

Renaissance Midcap Portfolio is a focused portfolio of midcap and small cap companies that are on path of strong growth and will lead to orbital change. The portfolio invests in select High Quality midcap businesses which have the potential to become a Large Caps in the future. The objective is to buy successful businesses at an early stage in their lifecycle and thereby benefit from compounding effects in growth over a long period.

INVESTMENT STRATEGY OF THE PORTFOLIO

Focused on companies with business leadership at an early stage in their life cycle

Typically very high growth companies

Identify Mid Cap / Small Cap ideas which can become tomorrow’s Large Cap / Mid Cap respectively

Low mortality portfolio

Long term approach to realise the full potential of the life cycle playing out

Focused portfolio of 20-25 stocks